Digital Patient Monitoring Devices Market, By Type (Telehealth, Wireless Sensor Technology, mHealth, Wearable Devices, and Remote Patient Monitoring), By Product (Therapeutic Monitoring Devices, and Diagnostic Monitoring Devices), and By Geography (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) Analysis, Share, Trends, Size, & Forecast From 2020 2026

|

Report ID

AV633

|

Published Date

June 2020

|

Pages

198

|

Industry

Healthcare

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

Digital patient monitoring devices market was valued at USD 39.7 billion by 2019, growing with 26.8% CAGR during the forecast period, 2020-2026.

Digital patient monitoring is a technology that allows patient monitoring beyond traditional clinical settings, such as at home or in a remote location, which can improve access to treatment and decrease the costs of healthcare service providers. The introduction of these emerging digital technologies has helped the healthcare industry to develop innovative patient care practices. Healthcare facilities around the globe are implementing this new technology that allows remote patient monitoring, to better tracking and treatment of patients throughout the entire episode. Patient monitoring devices should be designed to meet the needs of patient populations. Connected health and digital patient monitoring devices such as remote patient monitoring are more critical tools in the middle of the COVID-19 pandemic because they allow physicians to monitor patients without physical contact with them, thereby preventing the spread of the novel coronavirus.

Market Dynamics

An increasing number of chronic diseases such as high blood pressure and diabetes is one of the major factors boosting the demand for the real-time monitoring devices. For example, according to CDC’s National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP) data, the incidence of chronic diseases such as diabetes, cancer, and asthma is increasing at rapid pace globally. Furthermore, the rapidly emerging public health epidemic COVID-19 has witnessed the growing usage of telehealth and non-invasive tools for patient surveillance to promote patient management while minimizing patient and health care provider interaction and potential exposure to the virus.

Digital patient monitoring devices assist patients with continuous monitoring while at the same time providing remote access to patient data, further shortening time through clinical decisions. The demand for wireless monitoring devices is increasing across the globe due to their features and convenience. This has led manufacturers to develop remote neurological, cardiovascular, and respiratory monitoring devices, along with the increasing prevalence of neuro, heart, and breathing diseases. In addition, the launch of various wearable devices by companies such as Apple, Fitbit and Xiaomi is expected to offer growth opportunities to the market in the near future. However, high product cost coupled with lack of awareness in developing region will pull back the industry growth to some extent.

Type Takeaway

Based on the types, the global digital patient monitoring devices market has been categorized into wireless sensor technology, telehealth, remote patient monitoring, wearable devices, and mHealth. Remote patient monitoring products are further categorized into ambulatory patient monitoring, hospital inpatient monitoring, and smart home healthcare. Of the different types, wearable devices category dominated the market. Wearable devices with wearable sensors offer real-time monitoring of patients. Owing to the numerous properties associated with these devices such as the ease of operation, resistance to dust & water, and attractive designs of the devices is projected to spur product demand.

On the contrary, the mHealth segment if expected to grow at the highest CAGR owing to the increasing penetration of smartphones and faster internet access. Besides, mobile health technology enables patients with chronic heart disease or lung disease to enjoy better quality of life at an affordable cost. Surging utilization and support of an online platforms to generate optimistic health outcome coupled with the high preference for portable devices are estimated to propel the segment growth. Moreover, the remote patient monitoring segment is anticipated to grow at a promising growth rate in the upcoming years.

Product Takeaway

On the basis of product, the global market is divided into diagnostic and therapeutic monitoring devices. Diagnostic monitoring devices are further segmented into sleep monitors, fetal monitors, neuromonitors, and vital sign monitors. With the emerging prevalence of neurological disorders along with the growing geriatric population, the adoption of neuromonitors is increasing rapidly. For example, according to the National Institute of Neurological Disorders and Stroke (NINDS), the incidence of neurological disorders is increasing globally. On contrary, fetal monitors are growing with promising CAGR owing to the availability of variety of fetal monitors by key players. For example, GE Company offers Corometrics 250cx Series Fetal Monitor that provides detailed and personalized information on birthing experience.

Furthermore, therapeutic monitoring devices are sub-divided into respiratory monitors and insulin monitoring devices. In 2019, insulin monitoring devices held a substantial market share due to the increasing number of diabetic patients across the globe. Approval of new and advanced insulin delivery products will support segment growth.

Regional Takeaway

Owing to the supportive government initiatives and advanced healthcare infrastructure, the North American region dominated the global market, in 2019. Moreover, favourable reimbursement policies also may augment the regional market. In the U.S., the suitable reimbursement scenario is expected to enhance the demand for healthcare devices, thereby propelling the digital patient monitoring devices market. The Asia Pacific is anticipated to grow at the fastest pace with the rising geriatric population and improved healthcare facilities. Countries like China and India are emerging markets with the region.

Key Vendor Takeaway

Some of the key players that are actively responsible for the growth of this industry are GE Healthcare, AT&T, Inc., Athena Health, ResMed, Zephyr Technology Corporation, Garmin, Vital Connect, Medtronic, Fitbit, Inc., Welch Allyn, Omron Corporation, Phillips Healthcare, and St. Jude Medical.

Key players of the global digital patient monitoring devices market are majorly focusing on product innovation through constant research and development activities. These players also focus on the mergers, acquisition, and collaborations to maintain its position in market. Additionally, some of the players such as Philips Healthcare and BioTelemetry Inc. among others are focusing on the product and service expansion. For instance, in October 2018, Philips Healthcare announced the launch of IntelliVue Guardian Software application for patient monitoring. It is a new mobile app approved by the U.S. FDA and by the CE label. This mobile application is known as IntelliVue Guardian Software. With this launch, company has expanded its product portfolio. Moreover, in June 2018, BioTelemetry, Inc. introduced a wireless diabetes monitoring device to monitor blood glucose.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

DIGITAL PATIENT MONITORING DEVICES MARKET KEY PLAYERS

- Omron Corporation

- Fitbit, Inc.

- Medtronic plc

- Garmin International

- Vital Connect

- GE Healthcare

- AT&T, Inc.

- Athena Health

- Jude Medical

- Phillips Healthcare

- Welch Allyn

- Resmed Corporation

- Zephyr Technology Corporation

DIGITAL PATIENT MONITORING DEVICES MARKET, BY TYPE

- mHealth

- Telehealth

- Wearable Devices

- Wireless Sensor Technology

- Remote Patient Monitoring

- Ambulatory Patient Monitoring

- Hospital Inpatient Monitoring

- Smart Home Healthcare

DIGITAL PATIENT MONITORING DEVICES MARKET, BY PRODUCT

- Therapeutic Monitoring Devices

- Respiratory Monitors

- Insulin Monitoring Devices

- Others

- Diagnostic Monitoring Devices

- Sleep Monitors

- Fetal Monitors

- Vital Sign Monitors

- Neuromonitors

- Other Monitors

DIGITAL PATIENT MONITORING DEVICES MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

REPORT HIGHLIGHT

Digital patient monitoring devices market was valued at USD 39.7 billion by 2019, growing with 26.8% CAGR during the forecast period, 2020-2026.

Digital patient monitoring is a technology that allows patient monitoring beyond traditional clinical settings, such as at home or in a remote location, which can improve access to treatment and decrease the costs of healthcare service providers. The introduction of these emerging digital technologies has helped the healthcare industry to develop innovative patient care practices. Healthcare facilities around the globe are implementing this new technology that allows remote patient monitoring, to better tracking and treatment of patients throughout the entire episode. Patient monitoring devices should be designed to meet the needs of patient populations. Connected health and digital patient monitoring devices such as remote patient monitoring are more critical tools in the middle of the COVID-19 pandemic because they allow physicians to monitor patients without physical contact with them, thereby preventing the spread of the novel coronavirus.

Market Dynamics

An increasing number of chronic diseases such as high blood pressure and diabetes is one of the major factors boosting the demand for the real-time monitoring devices. For example, according to CDC’s National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP) data, the incidence of chronic diseases such as diabetes, cancer, and asthma is increasing at rapid pace globally. Furthermore, the rapidly emerging public health epidemic COVID-19 has witnessed the growing usage of telehealth and non-invasive tools for patient surveillance to promote patient management while minimizing patient and health care provider interaction and potential exposure to the virus.

Digital patient monitoring devices assist patients with continuous monitoring while at the same time providing remote access to patient data, further shortening time through clinical decisions. The demand for wireless monitoring devices is increasing across the globe due to their features and convenience. This has led manufacturers to develop remote neurological, cardiovascular, and respiratory monitoring devices, along with the increasing prevalence of neuro, heart, and breathing diseases. In addition, the launch of various wearable devices by companies such as Apple, Fitbit and Xiaomi is expected to offer growth opportunities to the market in the near future. However, high product cost coupled with lack of awareness in developing region will pull back the industry growth to some extent.

Type Takeaway

Based on the types, the global digital patient monitoring devices market has been categorized into wireless sensor technology, telehealth, remote patient monitoring, wearable devices, and mHealth. Remote patient monitoring products are further categorized into ambulatory patient monitoring, hospital inpatient monitoring, and smart home healthcare. Of the different types, wearable devices category dominated the market. Wearable devices with wearable sensors offer real-time monitoring of patients. Owing to the numerous properties associated with these devices such as the ease of operation, resistance to dust & water, and attractive designs of the devices is projected to spur product demand.

On the contrary, the mHealth segment if expected to grow at the highest CAGR owing to the increasing penetration of smartphones and faster internet access. Besides, mobile health technology enables patients with chronic heart disease or lung disease to enjoy better quality of life at an affordable cost. Surging utilization and support of an online platforms to generate optimistic health outcome coupled with the high preference for portable devices are estimated to propel the segment growth. Moreover, the remote patient monitoring segment is anticipated to grow at a promising growth rate in the upcoming years.

Product Takeaway

On the basis of product, the global market is divided into diagnostic and therapeutic monitoring devices. Diagnostic monitoring devices are further segmented into sleep monitors, fetal monitors, neuromonitors, and vital sign monitors. With the emerging prevalence of neurological disorders along with the growing geriatric population, the adoption of neuromonitors is increasing rapidly. For example, according to the National Institute of Neurological Disorders and Stroke (NINDS), the incidence of neurological disorders is increasing globally. On contrary, fetal monitors are growing with promising CAGR owing to the availability of variety of fetal monitors by key players. For example, GE Company offers Corometrics 250cx Series Fetal Monitor that provides detailed and personalized information on birthing experience.

Furthermore, therapeutic monitoring devices are sub-divided into respiratory monitors and insulin monitoring devices. In 2019, insulin monitoring devices held a substantial market share due to the increasing number of diabetic patients across the globe. Approval of new and advanced insulin delivery products will support segment growth.

Regional Takeaway

Owing to the supportive government initiatives and advanced healthcare infrastructure, the North American region dominated the global market, in 2019. Moreover, favourable reimbursement policies also may augment the regional market. In the U.S., the suitable reimbursement scenario is expected to enhance the demand for healthcare devices, thereby propelling the digital patient monitoring devices market. The Asia Pacific is anticipated to grow at the fastest pace with the rising geriatric population and improved healthcare facilities. Countries like China and India are emerging markets with the region.

Key Vendor Takeaway

Some of the key players that are actively responsible for the growth of this industry are GE Healthcare, AT&T, Inc., Athena Health, ResMed, Zephyr Technology Corporation, Garmin, Vital Connect, Medtronic, Fitbit, Inc., Welch Allyn, Omron Corporation, Phillips Healthcare, and St. Jude Medical.

Key players of the global digital patient monitoring devices market are majorly focusing on product innovation through constant research and development activities. These players also focus on the mergers, acquisition, and collaborations to maintain its position in market. Additionally, some of the players such as Philips Healthcare and BioTelemetry Inc. among others are focusing on the product and service expansion. For instance, in October 2018, Philips Healthcare announced the launch of IntelliVue Guardian Software application for patient monitoring. It is a new mobile app approved by the U.S. FDA and by the CE label. This mobile application is known as IntelliVue Guardian Software. With this launch, company has expanded its product portfolio. Moreover, in June 2018, BioTelemetry, Inc. introduced a wireless diabetes monitoring device to monitor blood glucose.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

DIGITAL PATIENT MONITORING DEVICES MARKET KEY PLAYERS

- Omron Corporation

- Fitbit, Inc.

- Medtronic plc

- Garmin International

- Vital Connect

- GE Healthcare

- AT&T, Inc.

- Athena Health

- Jude Medical

- Phillips Healthcare

- Welch Allyn

- Resmed Corporation

- Zephyr Technology Corporation

DIGITAL PATIENT MONITORING DEVICES MARKET, BY TYPE

- mHealth

- Telehealth

- Wearable Devices

- Wireless Sensor Technology

- Remote Patient Monitoring

- Ambulatory Patient Monitoring

- Hospital Inpatient Monitoring

- Smart Home Healthcare

DIGITAL PATIENT MONITORING DEVICES MARKET, BY PRODUCT

- Therapeutic Monitoring Devices

- Respiratory Monitors

- Insulin Monitoring Devices

- Others

- Diagnostic Monitoring Devices

- Sleep Monitors

- Fetal Monitors

- Vital Sign Monitors

- Neuromonitors

- Other Monitors

DIGITAL PATIENT MONITORING DEVICES MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. DIGITAL PATIENT MONITORING DEVICES MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Type

2.1.2. Market Snippet by Product

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. DIGITAL PATIENT MONITORING DEVICES KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. DIGITAL PATIENT MONITORING DEVICES INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

4.5. COVID-19 Impact Analysis

4.5.1. Pre-COVID-19 Impact Analysis

4.5.2. Post-COVID-19 Impact Analysis

5. DIGITAL PATIENT MONITORING DEVICES MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. DIGITAL PATIENT MONITORING DEVICES MARKET – BY TYPE

6.1. Overview

6.1.1. Segment Share Analysis, By Type, 2019 & 2026 (%)

6.2. Wearable Devices

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3. Wireless Sensor Technology

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4. Telehealth

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5. mHealth

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6. Remote Patient Monitoring

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6.3. Segment Share Analysis, By Remote Patient Monitoring Type, 2019 & 2026 (%)

6.6.3.1. Ambulatory Patient Monitoring

6.6.3.1.1. Overview

6.6.3.1.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6.3.2. Hospital Inpatient Monitoring

6.6.3.2.1. Overview

6.6.3.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6.3.3. Smart Home Healthcare

6.6.3.3.1. Overview

6.6.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7. DIGITAL PATIENT MONITORING DEVICES MARKET – BY PRODUCT

7.1. Overview

7.1.1. Segment Share Analysis, By Product, 2019 & 2026 (%)

7.2. Therapeutic Monitoring Devices

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.2.3. Sub-Segment Share Analysis, By Therapeutic Monitoring Devices, 2019 & 2026 (%)

7.2.3.1. Insulin Monitoring Devices

7.2.3.1.1. Overview

7.2.3.1.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.2.3.2. Respiratory Monitors

7.2.3.2.1. Overview

7.2.3.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.2.3.3. Other Therapeutic Devices

7.2.3.3.1. Overview

7.2.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3. Diagnostic Monitoring Devices

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.3. Segment Share Analysis, By Diagnostic Monitoring Devices, 2019 & 2026 (%)

7.3.3.1. Vital Sign Monitors

7.3.3.1.1. Overview

7.3.3.1.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.3.2. Sleep Monitors

7.3.3.2.1. Overview

7.3.3.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.3.3. Fetal Monitors

7.3.3.3.1. Overview

7.3.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.3.4. Neuromonitors

7.3.3.4.1. Overview

7.3.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3.3.5. Other Monitors

7.3.3.5.1. Overview

7.3.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8. DIGITAL PATIENT MONITORING DEVICES MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2019 & 2026 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.2.4. North America Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.2.5. North America Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.3.6. Germany

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.7. Italy

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.8. United Kingdom

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.9. France

8.3.9.1. Overview

8.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.10. Rest of Europe

8.3.10.1. Overview

8.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.4.6. India

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.7. China

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.8. Japan

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.9. South Korea

8.4.9.1. Overview

8.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.10. Rest of APAC

8.4.10.1. Overview

8.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5. Latin America

8.5.1. Overview

8.5.2. Key Manufacturers in Latin America

8.5.3. Latin America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.5.4. Latin America Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.5.5. Latin America Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.5.6. Brazil

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.7. Mexico

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.8. Argentina

8.5.8.1. Overview

8.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.9. Rest of LATAM

8.5.9.1. Overview

8.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6. Middle East and Africa

8.6.1. Overview

8.6.2. Key Manufacturers in Middle East and Africa

8.6.3. Middle East and Africa Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.6.4. Middle East and Africa Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.6.5. Middle East and Africa Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.6.6. Saudi Arabia

8.6.6.1. Overview

8.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6.7. United Arab Emirates

8.6.7.1. Overview

8.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. GE Healthcare

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. St. Jude Medical

9.3. Phillips Healthcare

9.4. Welch Allyn

9.5. Omron Corporation

9.6. Fitbit, Inc.

9.7. Medtronic plc

9.8. AT&T, Inc.

9.9. Resmed Corporation

9.10. Athena Health

9.11. Garmin International

9.12. Vital Connect

9.13. Zephyr Technology Corporation

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

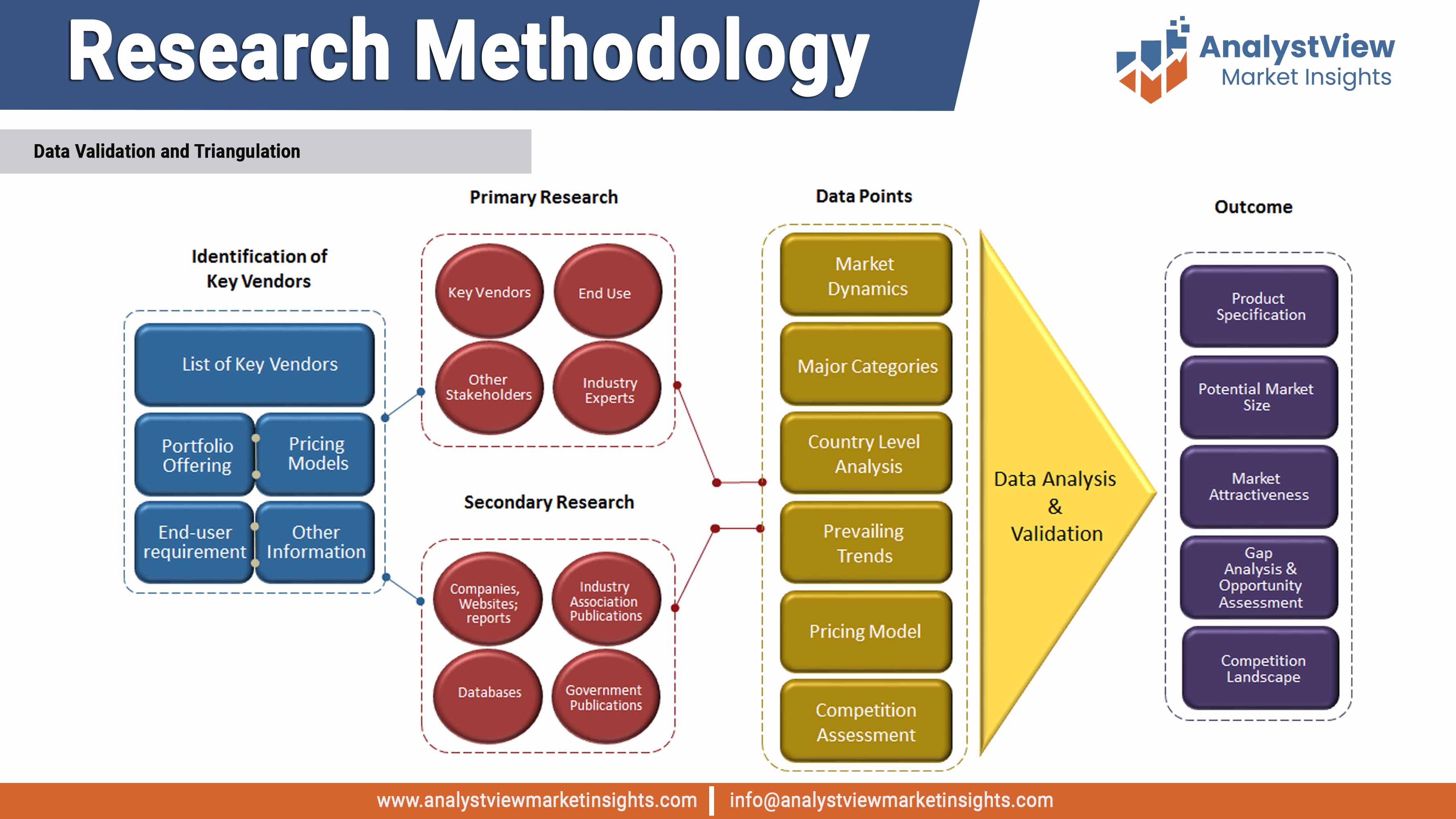

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Digital Patient Monitoring Devices market: Type Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Type

TABLE Global Digital Patient Monitoring Devices market, by Type 2015-2026 (USD Million)

TABLE Digital Patient Monitoring Devices market: Product Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Digital Patient Monitoring Devices market, by Product 2015-2026 (USD Million)

TABLE Digital Patient Monitoring Devices market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Digital Patient Monitoring Devices market, by Region 2015-2026 (USD Million)

TABLE North America Digital Patient Monitoring Devices market, by Country, 2015-2026 (USD Million)

TABLE North America Digital Patient Monitoring Devices market, by Type, 2015-2026 (USD Million)

TABLE North America Digital Patient Monitoring Devices market, by Product, 2015-2026 (USD Million)

TABLE Europe Digital Patient Monitoring Devices market, by country, 2015-2026 (USD Million)

TABLE Europe Digital Patient Monitoring Devices market, by Type, 2015-2026 (USD Million)

TABLE Europe Digital Patient Monitoring Devices market, by Product, 2015-2026 (USD Million)

TABLE Asia Pacific Digital Patient Monitoring Devices market, by country, 2015-2026 (USD Million)

TABLE Asia Pacific Digital Patient Monitoring Devices market, by Type, 2015-2026 (USD Million)

TABLE Asia Pacific Digital Patient Monitoring Devices market, by Product, 2015-2026 (USD Million)

TABLE Latin America Digital Patient Monitoring Devices market, by country, 2015-2026 (USD Million)

TABLE Latin America Digital Patient Monitoring Devices market, by Type, 2015-2026 (USD Million)

TABLE Latin America Digital Patient Monitoring Devices market, by Product, 2015-2026 (USD Million)

TABLE Middle East and Africa Digital Patient Monitoring Devices market, by country, 2015-2026 (USD Million)

TABLE Middle East and Africa Digital Patient Monitoring Devices market, byType, 2015-2026 (USD Million)

TABLE Middle East and Africa Digital Patient Monitoring Devices market, by Product, 2015-2026 (USD Million)

List of Figures

FIGURE Digital Patient Monitoring Devices market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE COVID-19 Impact Analysis

FIGURE Pre & Post COVID-19 Impact Comparision Study

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Type segment market share analysis, 2019 & 2026

FIGURE Type segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Wireless Sensor Technology market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE mHealth market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Telehealth market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Wearable Devices market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Remote Patient Monitoring market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Hospital Inpatient Monitoring market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Ambulatory Patient Monitoring market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Smart Home Healthcare market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Product segment market share analysis, 2019 & 2026

FIGURE Product segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Diagnostic Monitoring Devices market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Vital Sign Monitors market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Sleep Monitors market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Fetal Monitors market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Neuromonitors market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Therapeutic Monitoring Devices market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Insulin Monitoring Devices market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Respiratory Monitors market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Regional segment market share analysis, 2019 & 2026

FIGURE Regional segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE North America Digital Patient Monitoring Devices market share and leading players, 2018

FIGURE Europe Digital Patient Monitoring Devices market share and leading players, 2018

FIGURE Asia Pacific Digital Patient Monitoring Devices market share and leading players, 2018

FIGURE Latin America Digital Patient Monitoring Devices market share and leading players, 2018

FIGURE Middle East and Africa Digital Patient Monitoring Devices market share and leading players, 2018

FIGURE North America Digital Patient Monitoring Devices market share analysis by country, 2018

FIGURE U.S. Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Canada Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Europe Digital Patient Monitoring Devices market share analysis by country, 2018

FIGURE Germany Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Spain Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Italy Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE UK Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE FranceDigital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of the Europe Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Asia Pacific Digital Patient Monitoring Devices market share analysis by country, 2018

FIGURE India Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE China Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Japan Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE South Korea Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Singapore Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of APACDigital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin AmericaDigital Patient Monitoring Devices market share analysis by country, 2018

FIGURE BrazilDigital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Mexico Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Argentina Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of LATAM Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Digital Patient Monitoring Devices market share analysis by country, 2018

FIGURE Saudi Arabia Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE United Arab Emirates Digital Patient Monitoring Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS