Endodontic Devices Market, By Products Type (Hand pieces, Apex Locators, Endodontic Motors, Endodontic Scalers, Endodontic Lasers, Machine Assisted, Obturation System, Access Preparation, Shaping and Cleaning, and Obturation Materials), By End Use (Hospitals, Clinics, Dental Academic & Research Institutes), and By Geography (EU, NA, APAC, LATAM, and MEA) Analysis, Size, Share, Trends, & Forecast from 2020-2026

|

Report ID

AV635

|

Published Date

June 2020

|

Pages

188

|

Industry

Healthcare

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

Endodontic devices market was valued at USD 1.62 billion by 2019, growing with 4.3% CAGR during the forecast period, 2020-2026.

Endodontic Devices are used by the dental professional practitioners for the treatment of various dental disorders. These devices consist of various surgical instruments, and consumables used for the treatment of patients to perform a root canal and Endodontic tools are used in the cleaning, shaping the teeth as well as mechanical debridement of the root canal in the deep length of the apical foramen. Endodontic procedures require high professional skills as it should be handled with care and precision hence require the right equipment for efficient and positive outcomes. Recently many machine-assisted, rotary tools and electric motor-assisted endodontic devices are available with additional features & facilities. The facilities include adjustable temperature settings, refillable cartridge, precise torque control, quick heating elements, and variable power settings knobs as well as a fast and continuous flow of filling material via a gun.

Market Dynamics

The increasing prevalence of dental & oral disorders, the government supports as well as rising medical tourism for such non-communicable disorders are major factors boosting the growth of the global endodontic devices market. According to the report of the Global Burden of Disease in 2017, oral diseases have been affected by approximately 3.5 billion people globally. This is primarily due to untreated conditions of teeth decay, rising tobacco consumption, as well as more than 530 million children, suffer from primary teeth dental caries. This rise in the disease has boosted the demand for the endodontic devices market during the forecast period.

Moreover, technological advancements with revolutionized endodontic devices using the cordless technology, next-generation adaptive motion technology for endodontic instrument motors. In addition, rising government initiatives and supports to conduct campaigns are likely to create lucrative growth opportunities in the worldwide market during the forecast period. For instance, in September 2019, Kerr Endodontic has been launched the new, cordless elements named IC obturation system. Conversely, high risk of root fracture as well as some side effects associated with endodontic devices is predicted to impede the market growth in the coming future. However, it is noted that advanced technology offers safe, secure, and promising in the treatment of oral disorders can create the demand for this market during the forecast period.

Product Types Takeaway

In terms of products, the worldwide endodontic devices market is categorized into instruments and consumables. Of these, the instruments accounted for the majority of the market share in 2019. This is mainly due to the growing demand for such instruments in hospitals and dental clinics. The use of endodontic motors instrument in these facilities is increasing to take care of patients suffering from dental disease and to carry out the root canal process. In addition to this, increasing the use of advanced and innovative Nickel-Titanium (NiTi) based instruments would, in turn, further boost the segment growth. This instrument segment is broadly categorized into endodontic scalers, machine-assisted obturation systems, handpieces, apex locators, endodontic motors, and endodontic lasers.

On the other side, the consumables segment is projected to grow with a promising growth rate during the future period. This segment is further divided into shaping and cleaning (files & shapers, and irrigation solutions & lubricants), access preparation (burs, and drills), and obturation materials (plastic, metals, cement & pastes- calcium phosphates, and mineral trioxide aggregate).

End-User Takeaway

By end-users, the global market is categorized into dental hospitals & clinics and dental academics & research institutes. The hospitals accounted for the largest market share in 2019 and are anticipated to grow exponentially during the forecast period. This growth is primarily owing to the increased number of visits to hospital visits due to rise in the dental disorders and growing dental care. Dental treatment awareness is a growing concern in the geriatric populations. In addition, dental clinics are mostly preferred by patients for cleaning of teeth and other treatment procedures like a root canal, etc in developed countries. This is expected to drive the clinic’s segment growths in the coming future.

Regional Takeaway

Regionally, the overall market is divided into North America, Middle East & Africa, Asia Pacific, Latin America, and Europe. The North America endodontic devices market registered the majority of the market share in 2019 owing to the rising geriatric population. As per the Administration for Community Living (ACL), in North America, the geriatric population above 65 groups was increased from 37.2 million in 2006 to 49.2 million in 2016 with a 33% rise. The organization has also stated that the geriatric population is projected to reach 100 million by 2060. It is analyzed that the dental disorder is higher in the elderly population due to certain health-related issues like tooth loss, teeth cavities, etc. Thus, the aging population is considered to be one of the most important driving factors for the growth of the North American market. In addition to this, factors such as technological advancements for diagnosis & treatment of dental disorders, rising awareness about dental care, coupled with the availability of government & private funding are fuelling the regional market growth.

On the flip side, the Asia Pacific is anticipated to be the fastest-growing region throughout the forecast. The growth is attributed to the growing prevalence of clinical disorders such as oral cancer due to an increase in the consumption of tobacco, and alcohol. Furthermore, rising medical tourism and the evolution of 3D printed implantation of teeth are also contributing to the regional market demand.

COVID-19 Impact

The endodontic devices market is adversely affected due to the sudden outbreak of COVID-19 all over the globe. The Endodontic devices are specially used by the dental healthcare professionals and as per the World Health Organization (WHO) guidelines, the COVID-29 virus can spread through any medium by face-to-face communication, sneezing and these dental professional have consistent exposure to body fluids such as blood and saliva predispose dental care workers and are being subjected to high risk for COVID-19 infection. As demonstrated by the recent corona-virus outbreak, dental practice has been stopped hence the demand for these endodontic devices has been slightly decreased and will remain in the global market to be sustained in the near future.

Key Vendor Takeaway

The leading players of the global Endodontic Devices market include Dentsply Sirona, Danaher Corporation, FKG Dentaire S.A., Ivoclar Vivadent AG, Ultradent Products, Inc., Septodont, Micro-Mega SA, Coltene Holding, DiaDent Group International, and Brasseler Holdings, LLC.

Companies are actively involved in strategic mergers and acquisitions to capture a large customer base. In February 2020, Danaher has been acquired the Biopharma Business of General Electric Life Sciences and named Cytiva. This acquisition helped the company to obtain a standalone operating company within Danaher’s Life Sciences segment in the global industry.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

ENDODONTIC DEVICES MARKET KEY PLAYERS

- Dentsply Sirona

- Danaher Corporation

- FKG Dentaire S.A.

- Ivoclar Vivadent AG

- Ultradent Products, Inc.

- Septodont

- Micro-Mega SA

- Coltene Holding

- DiaDent Group International

- Brasseler Holdings, LLC

ENDODONTIC DEVICES MARKET, BY PRODUCT TYPES

- Endodontic Instruments

- Handpieces

- Apex Locators

- Endodontic Motors

- Endodontic Scalers

- Endodontic Lasers

- Machine Assisted Obturation Systems

- Others

- Endodontic Consumables

- Access Preparation

- Burs

- Drills

- Shaping and Cleaning

- Irrigation Solutions & Lubricants

- Files & Shapers

- ObturationMaterials

- Cements & Pastes

- Mineral Trioxide Aggregate (MTA)

- Calcium Phosphates

- Others

- Metals

- Plastic

- Cements & Pastes

- Access Preparation

ENDODONTIC DEVICES MARKET, BY END USERS

- Dental Hospitals

- Dental Academic & Research Institutes

- Dental Clinics

ENDODONTIC DEVICES MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. ENDODONTIC DEVICES MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by End User

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. ENDODONTIC DEVICESKEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. ENDODONTIC DEVICES INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

4.5. COVID-19 Impact Analysis

4.5.1. Pre-COVID-19 Impact Analysis

4.5.2. Post-COVID-19 Impact Analysis

5. ENDODONTIC DEVICES MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. ENDODONTIC DEVICES MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Product, 2019 & 2026 (%)

6.2. Instruments

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.3. Endodontic Scalers

6.2.3.1. Overview

6.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.4. Machine Assisted Obturation Systems

6.2.4.1. Overview

6.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.5. Handpieces

6.2.5.1. Overview

6.2.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.6. Endodontic Motors

6.2.6.1. Overview

6.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.7. Apex Locators

6.2.7.1. Overview

6.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.8. Endodontic Lasers

6.2.8.1. Overview

6.2.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3. Consumables

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.3. Shaping and Cleaning

6.3.3.1. Overview

6.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.3.3. Files & Shapers

6.3.3.3.1. Overview

6.3.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.3.4. Irrigation Solutions & Lubricants

6.3.3.4.1. Overview

6.3.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.4. Access Preparation

6.3.4.1. Overview

6.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.4.3. Burs

6.3.4.3.1. Overview

6.3.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.4.4. Drills

6.3.4.4.1. Overview

6.3.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.5. Obturation Materials

6.3.5.1. Overview

6.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.5.3. Plastic

6.3.5.3.1. Overview

6.3.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.5.4. Metals

6.3.5.4.1. Overview

6.3.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.5.5. Cements & Pastes

6.3.5.5.1. Overview

6.3.5.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.5.5.3. Calcium Phosphates

6.3.5.5.3.1. Overview

6.3.5.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.5.5.4. Mineral Trioxide Aggregate (MTA)

6.3.5.5.4.1. Overview

6.3.5.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.5.5.5. Others

6.3.5.5.5.1. Overview

6.3.5.5.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7. ENDODONTIC DEVICES MARKET – BY END USER

7.1. Overview

7.1.1. Segment Share Analysis, By End User, 2019 & 2026 (%)

7.2. Dental Hospitals

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3. Dental Clinics

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4. Dental Academic & Research Institutes

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8. ENDODONTIC DEVICES MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2019 & 2026 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.2.5. North America Market Size and Forecast, By End User, 2015 – 2026 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.3.5. Europe Market Size and Forecast, By End User, 2015 – 2026 (US$ Million)

8.3.6. Germany

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.7. Italy

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.8. United Kingdom

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.9. France

8.3.9.1. Overview

8.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.10. Rest of Europe

8.3.10.1. Overview

8.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By End User, 2015 – 2026 (US$ Million)

8.4.6. India

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.7. China

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.8. Japan

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.9. South Korea

8.4.9.1. Overview

8.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.10. Rest of APAC

8.4.10.1. Overview

8.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5. Latin America

8.5.1. Overview

8.5.2. Key Manufacturers in Latin America

8.5.3. Latin America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.5.4. Latin America Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.5.5. Latin America Market Size and Forecast, By End User, 2015 – 2026 (US$ Million)

8.5.6. Brazil

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.7. Mexico

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.8. Argentina

8.5.8.1. Overview

8.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.9. Rest of LATAM

8.5.9.1. Overview

8.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6. Middle East and Africa

8.6.1. Overview

8.6.2. Key Manufacturers in Middle East and Africa

8.6.3. Middle East and Africa Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.6.4. Middle East and Africa Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.6.5. Middle East and Africa Market Size and Forecast, By End User, 2015 – 2026 (US$ Million)

8.6.6. Saudi Arabia

8.6.6.1. Overview

8.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6.7. United Arab Emirates

8.6.7.1. Overview

8.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Dentsply Sirona

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Ultradent Products

9.3. Ivoclar Vivadent

9.4. FKG Dentaire

9.5. Danaher Corporation

9.6. Septodont

9.7. COLTENE

9.8. Micro-Mega

9.9. Brasseler Holdings

9.10. DiaDent Group International

9.11. Other Players

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

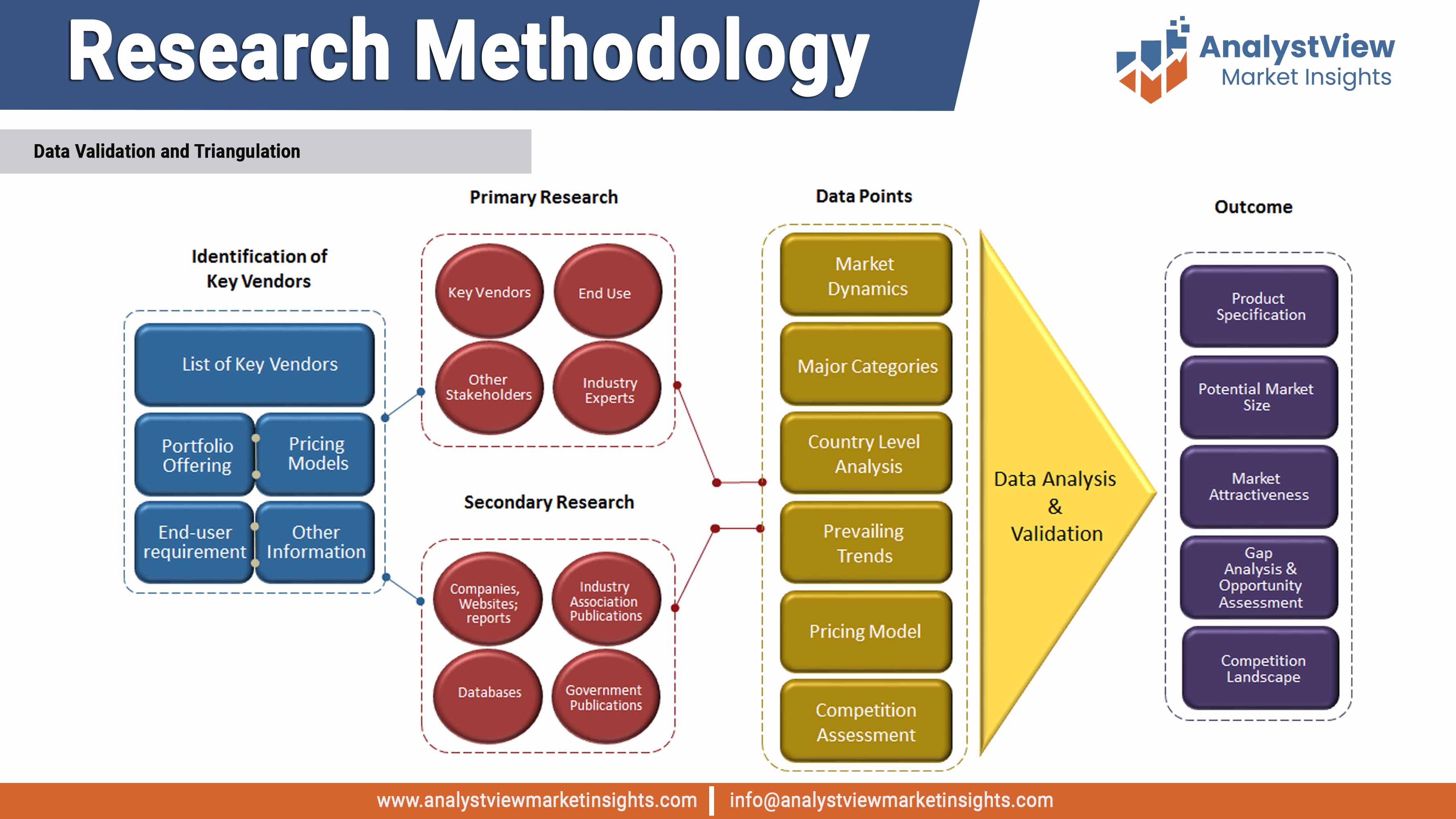

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Endodontic Devices market: Product Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Endodontic Devices market, by Product 2015-2026 (USD Million)

TABLE Endodontic Devices market: End User Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by End User

TABLE Global Endodontic Devices market, by End User 2015-2026 (USD Million)

TABLE Endodontic Devices market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Endodontic Devices market, by Region 2015-2026 (USD Million)

TABLE North America Endodontic Devices market, by Country, 2015-2026 (USD Million)

TABLE North America Endodontic Devices market, by Product, 2015-2026 (USD Million)

TABLE North America Endodontic Devices market, by End User, 2015-2026 (USD Million)

TABLE Europe Endodontic Devices market, by Country, 2015-2026 (USD Million)

TABLE Europe Endodontic Devices market, by Product, 2015-2026 (USD Million)

TABLE Europe Endodontic Devices market, by End User, 2015-2026 (USD Million)

TABLE Asia Pacific Endodontic Devices market, by Country, 2015-2026 (USD Million)

TABLE Asia Pacific Endodontic Devices market, by Product, 2015-2026 (USD Million)

TABLE Asia Pacific Endodontic Devices market, by End User, 2015-2026 (USD Million)

TABLE Latin America Endodontic Devices market, by Country, 2015-2026 (USD Million)

TABLE Latin America Endodontic Devices market, by Product, 2015-2026 (USD Million)

TABLE Latin America Endodontic Devices market, by End User, 2015-2026 (USD Million)

TABLE Middle East and Africa Endodontic Devices market, by Country, 2015-2026 (USD Million)

TABLE Middle East and Africa Endodontic Devices market, by Product, 2015-2026 (USD Million)

TABLE Middle East and Africa Endodontic Devices market, by End User, 2015-2026 (USD Million)

List of Figures

FIGURE Endodontic Devices market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE COVID-19 Impact Analysis

FIGURE Pre & Post COVID-19 Impact Comparision Study

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2019 & 2026

FIGURE Product segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Instruments market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Endodontic Scalers market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Machine Assisted Obturation Systems market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Handpieces market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Apex Locators market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Endodontic Motors market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Endodontic Lasers market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Endodontic Consumables market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Shaping and Cleaning market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Files & Shapers market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Irrigation Solutions & Lubricants market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Access Preparation market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Burs market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Drills

Obturation Materials market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Plastic market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Metals market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Cements & Pastes market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Calcium Phosphates market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Mineral Trioxide Aggregate (MTA) market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE End User segment market share analysis, 2019 & 2026

FIGURE End User segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Dental Clinics market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Dental Hospitals market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Dental Academic & Research Institutes market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Others market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Regional segment market share analysis, 2019 & 2026

FIGURE Regional segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE North America Endodontic Devices market share and leading players, 2018

FIGURE Europe Endodontic Devices market share and leading players, 2018

FIGURE Asia Pacific Endodontic Devices market share and leading players, 2018

FIGURE Latin America Endodontic Devices market share and leading players, 2018

FIGURE Middle East and Africa Endodontic Devices market share and leading players, 2018

FIGURE North America market share analysis by country, 2018

FIGURE U.S. Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Canada Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Europe Endodontic Devices market share analysis by country, 2018

FIGURE Germany Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Spain Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Italy Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE UK Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE France Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of the Europe Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Asia Pacific Endodontic Devices market share analysis by country, 2018

FIGURE India Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE China Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Japan Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE South Korea Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Singapore Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of APAC Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Endodontic Devices market share analysis by country, 2018

FIGURE Brazil Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Mexico Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Argentina Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of LATAM Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Endodontic Devices market share analysis by country, 2018

FIGURE Saudi Arabia Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE United Arab Emirates Endodontic Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS