Foot and Ankle Devices Market, By Product (Soft Tissue Orthopedic Devices, Bracing and Support, Joint Implants, Prosthetics, and Orthopedic Fixation), By Application (Trauma, Osteoarthritis, Hammertoe, Neurological Disorders, Bunions, Osteoporosis, and Rheumatoid Arthritis) and By Geography (NA, EU, APAC, LATAM and MEA) Analysis, Share, Trends, Size, & Forecast From 2020 2026

|

Report ID

AV595

|

Published Date

May 2020

|

Pages

188

|

Industry

Healthcare

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

Foot and ankle devices market was valued at USD 1.73 billion in 2019, growing with 11.8% CAGR during the forecast period, 2020-2026.

Market Dynamics

Foot and ankle devices are used to treat any orthopedic injuries related to lower limb joint or foot. It includes walker boots, ankle braces, arch support, ankle sleeves, insoles, and many more products. The foot and ankle devices help in healing the injuries or damages without undergoing any surgical procedures. These products are lightweight, durable, and provides excellent support to the ankle and foot with injuries. In addition to this, it helps in improving overall patient care and healthcare experience for medical professionals.

The demand for foot and ankle devices is on rising owing to the increasing prevalence of foot-related orthopedic issues. The rise in the population suffering from rheumatoid arthritis, fractures, osteoporosis, and many others, is driving the demand for foot and ankle devices. As per the Centers for Disease Control and Prevention (CDC), in 2017, around 54.4 million population resident in the US suffers from arthritis, which is equal to 25% of the total population. Also, increasing the elderly population who are more prone to injuries are another factor fuelling the market demand. The World Health Organization (WHO) revealed that the global aged population (over 60 years of age) statistics are projected to up-rise to 2 billion by end of 2050 when compared to 900 million in 2015.

The growth of this market is further dragged by increasing road accidents leading to fractures along with the higher prevalence of injuries among sports enthusiasts. With this, the demand for devices and accessories to offer support in the ankle and foot for rapid recovery pushes the market growth upwards. Also, continuous research for the development of devices using more advanced technology to improve treatment is also creating new growth opportunities for this market. However, the high cost of the device in combination with non-supportive reimbursement for these devices acts as a major roadblock for market growth.

Product Takeaway

In terms of different products, the worldwide foot, and ankle devices industry is broadly divided into joint implants, bracing and support, prosthetics, orthopedic fixation, and soft tissue orthopedic devices. Among which, as of 2019, the joint implants have gained significant market share owing to the increasing elderly population with higher success and efficiency of the joint implant surgery to retain the mobility. Rising awareness regarding joint replacement surgeries with increasing life expectancy has created a higher desire to undergo implant surgeries, driving the segmental growth. The emergence of new technologies and materials offering longer life is further fuels the segmental growth.

Followed by joint implants, the prosthetics category emerged as the most important segment accounting for the market value of over 100 million in 2019. The growth of this segment is accountable for increasing product demand among the sportsperson.

Application Takeaway

Depending upon the application, the market is segmented into neurological disorders, osteoarthritis, hammertoe, rheumatoid arthritis, bunions, trauma, and osteoporosis. Trauma cases of the ankle and foot are more common and thus have gained a dominating position. Increasing trauma cases, an outcome of sports-related injuries, accidents, and improper physical training is leading to a higher prevalence of trauma cases.

Also, hammertoe has also gained significant market share in 2019. Hammertoe can be well treated through non-surgical or non-invasive treatment including orthotic devices that help in controlling the muscle imbalance. The National Foot Health Assessment report revealed that more than 7 million American adults suffer from hammertoes every year. The organization also stated that a lack of awareness regarding this condition leads to permanent foot deformities, thus resulting in a growing need for appropriate foot correctors and supporters.

Regional Takeaway

The growing elderly population and a higher prevalence of sports injuries are pushing the market demand in North America. The Stanford Children’s Health stated that over 30 million children are actively involved in any of the sports in the U.S alone, with more than 3.5 million injuries annually. North America is the leading regional market for the foot and ankle device market. The rapid adoption of emerging technologies, a well-developed healthcare sector with a growing diabetic population in the region driving the market growth. Asia-Pacific is the fastest-growing regional market owing to the increasing patient pool suffering from arthritis, osteoporosis, and injuries.

Key Vendor Takeaway

Some of the key players that are actively operating in this industry are Wright Medical Group, Stryker Corporation, DePuy Synthes, Smith & Nephew, Zimmer Biomet, Advanced Orthopaedic Solutions, Integra LifeSciences Corporation, Acumed, Össur, and Bioretec Limited.

The key companies are involved in strategic partnerships and acquisitions to increase the geographical reach, product portfolio to gain a high market share. For instance, in 2019, Stryker announced the acquisition of Wright Medical at USD 5.4 billion. Also, in 2016, the Zimmer Biomet Holdings Inc. signed a distribution agreement with the Nextremity Solutions for distribution of foot and ankle deformity correction product.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

GLOBAL FOOT AND ANKLE DEVICES MARKET KEY PLAYERS

- DePuy Synthes Companies

- Stryker Corporation

- Zimmer Biomet

- Smith & Nephew

- Wright Medical Group N.V.

- Advanced Orthopaedic Solutions

- Integra LifeSciences Corporation

- Acumed

- Össur

- Bioretec Ltd.

GLOBAL FOOT AND ANKLE DEVICES MARKET, BY TYPE

- Prosthetics

- Bracing and Support

- Orthopedic Fixation

- Soft Tissue Orthopedic Devices

- Joint Implants

GLOBAL FOOT AND ANKLE DEVICES MARKET, BY APPLICATION

- Osteoarthritis

- Osteoporosis

- Hammertoe

- Rheumatoid Arthritis

- Neurological Disorders

- Bunions

- Trauma

GLOBAL FOOT AND ANKLE DEVICES MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. FOOT AND ANKLE DEVICES MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Product

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. FOOT AND ANKLE DEVICES KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. FOOT AND ANKLE DEVICES INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

4.5. COVID-19 Impact Analysis

4.5.1. Pre-COVID-19 Impact Analysis

4.5.2. Post-COVID-19 Impact Analysis

5. FOOT AND ANKLE DEVICES MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. FOOT AND ANKLE DEVICES MARKET – BY PRODUCT

6.1. Overview

6.1.1. Segment Share Analysis, By Type, 2019 & 2026 (%)

6.2. Bracing and Support

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3. Joint Implants

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4. Soft Tissue Orthopedic Devices

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5. Orthopedic Fixation

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6. Prosthetics

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7. FOOT AND ANKLE DEVICES MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2019 & 2026 (%)

7.2. Hammertoe

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3. Trauma

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4. Osteoarthritis

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.5. Neurological Disorders

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.6. Bunions

7.6.1. Overview

7.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.7. Osteoporosis

7.7.1. Overview

7.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8. FOOT AND ANKLE DEVICES MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2019 & 2026 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.2.4. North America Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.2.6. The U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.3.6. Germany

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.7. Italy

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.8. United Kingdom

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.9. France

8.3.9.1. Overview

8.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.10. Rest of Europe

8.3.10.1. Overview

8.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in the Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.4.6. India

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.7. China

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.8. Japan

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.9. South Korea

8.4.9.1. Overview

8.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.10. Rest of APAC

8.4.10.1. Overview

8.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5. Latin America

8.5.1. Overview

8.5.2. Key Manufacturers in Latin America

8.5.3. Latin America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.5.4. Latin America Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.5.5. Latin America Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.5.6. Brazil

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.7. Mexico

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.8. Argentina

8.5.8.1. Overview

8.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.9. Rest of LATAM

8.5.9.1. Overview

8.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6. The Middle East and Africa

8.6.1. Overview

8.6.2. Key Manufacturers in the Middle East and Africa

8.6.3. The Middle East and Africa Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.6.4. The Middle East and Africa Market Size and Forecast, By Product, 2015 – 2026 (US$ Million)

8.6.5. The Middle East and Africa Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.6.6. Saudi Arabia

8.6.6.1. Overview

8.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6.7. United Arab Emirates

8.6.7.1. Overview

8.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Stryker Corporation

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. DePuy Synthes Companies

9.3. Zimmer Biomet

9.4. Advanced Orthopaedic Solutions

9.5. Integra LifeSciences Corporation

9.6. Acumed

9.7. Smith & Nephew

9.8. Wright Medical Group N.V.

9.9. Össur

9.10. Bioretec Ltd.

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

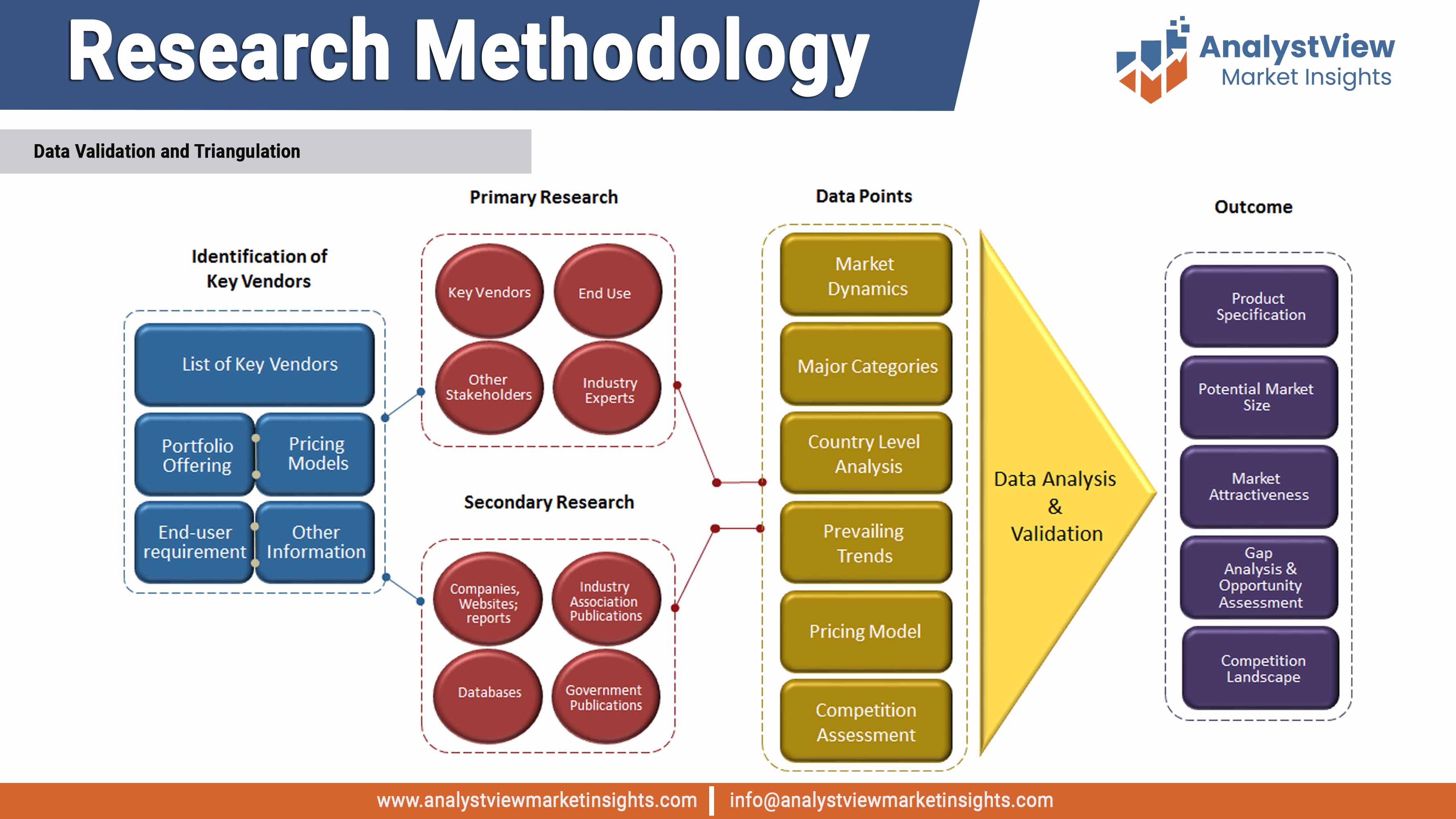

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Foot and Ankle Devices market: Product Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Product

TABLE Global Foot and Ankle Devices market, by Product 2015-2026 (USD Million)

TABLE Foot and Ankle Devices Market: Application Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Foot and Ankle Devices market, by Application 2015-2026 (USD Million)

TABLE Foot and Ankle Devices Market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Foot and Ankle Devices market, by Region 2015-2026 (USD Million)

TABLE North America Foot and Ankle Devices market, by Country, 2015-2026 (USD Million)

TABLE North America Foot and Ankle Devices market, by Product, 2015-2026 (USD Million)

TABLE North America Foot and Ankle Devices market, by Application, 2015-2026 (USD Million)

TABLE Europe Foot and Ankle Devices market, by country, 2015-2026 (USD Million)

TABLE Europe Foot and Ankle Devices market, by Product, 2015-2026 (USD Million)

TABLE Europe Foot and Ankle Devices market, by Application, 2015-2026 (USD Million)

TABLE Asia Pacific Foot and Ankle Devices market, by country, 2015-2026 (USD Million)

TABLE Asia Pacific Foot and Ankle Devices market, by Product, 2015-2026 (USD Million)

TABLE Asia Pacific Foot and Ankle Devices market, by Application, 2015-2026 (USD Million)

TABLE Latin America Foot and Ankle Devices market, by country, 2015-2026 (USD Million)

TABLE Latin America Foot and Ankle Devices market, by Product, 2015-2026 (USD Million)

TABLE Latin America Foot and Ankle Devices market, by Application, 2015-2026 (USD Million)

TABLE Middle East and Africa Foot and Ankle Devices market, by country, 2015-2026 (USD Million)

TABLE Middle East and Africa Foot and Ankle Devices market, by Product, 2015-2026 (USD Million)

TABLE Middle East and Africa Foot and Ankle Devices market, by Application, 2015-2026 (USD Million)

List of Figures

FIGURE Foot and Ankle Devices market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE COVID-19 Impact Analysis

FIGURE Pre & Post COVID-19 Impact Comparision Study

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Product segment market share analysis, 2019 & 2026

FIGURE Product segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Bracing and Support market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Joint Implants market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Soft Tissue Orthopedic Devices market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Orthopedic Fixation market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Prosthetics market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Application segment market share analysis, 2019 & 2026

FIGURE Application segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Hammertoe market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Trauma market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Osteoarthritis market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rheumatoid Arthritis market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Neurological Disorders market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Bunions market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Osteoporosis market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Regional segment market share analysis, 2019 & 2026

FIGURE Regional segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE North America Foot and Ankle Devices market share and leading players, 2018

FIGURE Europe Foot and Ankle Devices market share and leading players, 2018

FIGURE Asia Pacific Foot and Ankle Devices market share and leading players, 2018

FIGURE Latin America Foot and Ankle Devices market share and leading players, 2018

FIGURE Middle East and Africa Foot and Ankle Devices market share and leading players, 2018

FIGURE North America Foot and Ankle Devices market share analysis by country, 2018

FIGURE U.S. Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Canada Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Europe Foot and Ankle Devices market share analysis by country, 2018

FIGURE Germany Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Spain Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Italy Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE UK Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE France Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of the Europe Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Asia Pacific Foot and Ankle Devices market share analysis by country, 2018

FIGURE India Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE China Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Japan Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE South Korea Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Singapore Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of APAC Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Foot and Ankle Devices market share analysis by country, 2018

FIGURE Brazil Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Mexico Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Argentina Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of LATAM Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Foot and Ankle Devices market share analysis by country, 2018

FIGURE Saudi Arabia Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE United Arab Emirates Foot and Ankle Devices market size, forecast and trend analysis, 2015 to 2026 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS