Medical Robotic Systems Market, By Type (Rehabilitation Robots, Orthopaedic Surgical Robots, Neurosurgical Robotic Systems, Non-invasive Radiosurgery Robots, Laparoscopy Robotic Systems, Steerable Robotic Catheters, Emergency Response Robotic Systems, and Hospital and Pharmacy Robots), By Application (Laparoscopy, Special Education, Neurology, and Orthopaedics),and By Geography (NA, EU, APAC, LATAM and MEA) Analysis, Share, Trends, Size, & Forecast From 2020 2026

|

Report ID

AV624

|

Published Date

June 2020

|

Pages

233

|

Industry

Healthcare

|

|

|

Base Year

2025

|

Historical Data

2019-2024

|

Delivery Timeline

24 Hour

|

REPORT HIGHLIGHT

Medical robotic systems market was valued at USD 7.69 billion by 2019, growing with 12.8% CAGR during the forecast period, 2020-2026

Medical robotics is the integrated system that automates the operations tasks during the surgery using artificial intelligence. The Robot Institute of America (RIA) defined medical robots as a multifunctional and reprogrammable manipulator which is designed to move medical materials, tools, parts, or specialized devices through programmed motions for the performance of surgical tasks. Such systems allow operators to act more accurately than the assisted human companion. These are the artificial intelligence-based surgical assistance system. With the help of this system, the surgeon has to make tiny incisions in the human body or sometimes no skin incisions have to make at all. However, in the conventional method relatively large incisions have to make on the patient’s body. A high-definition three-dimensional camera or miniaturized instruments are inserted into the patient’s body in the procedure by the surgeon through the nearby console.

Medical robotics holds great potential in the healthcare industry by providing various assistance in surgical procedures and bringing down the cost of healthcare. The industry is ultimately an application-driven research field. Thus, the development of new product applications would require significant innovation and fundamental advancements in technologies.

Market Dynamics

The medical robotics industry is causing a paradigm shift in healthcare therapy. Technology advancements are considered to be one of the primary driving factors for the growth of the global medical robotics industry. For instance, recently in October 2018, Medrobotics declared the first sale of the product for gastroenterology applications called Flex Robotic System in Europe. This system enables physicians to access the body’s anatomical locations that were difficult to reach minimally invasively. Such introductions would, in turn, expand the scope of medical robots in various applications, driving the industry growth significantly. Furthermore, the issuance of Independent Practice Organizations (IPOs) by medical robotic players is supporting the industry growth especially market demand among the clinic’s category.

An increasing number of minimally invasive surgeries are projected to further create a huge opportunity for the medical robotics market, especially in developed regions, including North America and Europe. The rising preference for minimally invasive procedures is majorly attributed to its considerable cost savings, faster recovery periods, increased safety, reduced pain, decreased scarring, fewer cuts, and smaller incisions. A study performed by the U.S. based medical device company, EndoEvolution, stated that more than 1.5 million minimally invasive surgeries are performed in the U.S. every year. Robotic surgeries are normally associated with minimally invasive procedures that are performed through tiny incisions. Thus, the demands for medical robots will increase as the number of minimally invasive procedures rises.

Owing to the aforementioned facts, the overall number of robotic medical procedures is increasing at a constant rate. As per the U.S. FDA, in 2017, around 877,000 procedures were performed using intuitive surgical robots across the globe. On the contrary, factors such as technical complications while performing surgeries coupled with high cost will pull back the industry growth. As per the study performed by the U.S. FDA, from 2000 till now, the medical robotic system is linked to 8.1K device malfunctions, 1.4K injuries, and around 150 deaths.

Type Takeaway

Depending upon types, the global medical robotic systems market is categorized into emergency response, hospital and pharmacy, non-invasive radiosurgery, surgical, and rehabilitation robots. The surgical category is further categorized into neurosurgical (Pathfinder, Renaissance, and NeuroMate), orthopedic (iBlock, Robodoc, Stanmore Sculptor, MAKO RIO, and Navio PFSsurgical system), laparoscopy (Da Vinci, FreeHand endoscope holder, and Telelap ALF-X), and steerable robotic catheters. The rehabilitation product category is further classified as orthotics, assistive robots, prosthetics, therapeutic robots, and exoskeleton robotic systems. Hospital robots are further divided into telemedicine, intravenous, pharmacy, and cart transportation robots. Emergency robotic products are sub-classified into the LS-1 robotic system, and auto pulse plus robotic system. Whereas, non-invasive radiosurgery robots are sub-divided into TrueBeamSTx, CyberKnife, and Gamma Knife Perfexion radiosurgery system.

Among the aforementioned segments, the surgical product category accounted for the highest revenue share owing to the growing adoption rate of this equipment in hospital facilities. Of the different surgical robots, it is analyzed that the steerable catheter system is projected to grow with the fastest CAGR of over 13% from 2019 to 2026. On the other side, the therapeutic robot segment is anticipated to expand at a rapid pace during the study period. The development of therapeutic robots has revolutionized the practice of physical medicine. Growth of this category is majorly attributed to the rapid technological developments in terms of cloud technology, adaptive programming, and voice recognition to strengthen the utility and efficiency of the overall product performance.

Application Takeaway

In terms of applications, the industry is broadly segmented as special education, laparoscopy, orthopedics robotic systems, and neurology. As robotic process approaches for commercial use, the global industry is diversifying with novel surgical modalities, new technologies, and smaller product sizes. Of the different applications, the laparoscopy segment accounted for the highest revenue share owing to the availability of high precision robots for laparoscopic surgeries.

On the other hand, with the improvement in precision and accuracy, robot-assisted surgeries in orthopedic procedures are anticipated to propel market growth in the coming years. Advancement in technologies pertaining to the development of Image-Guided Orthopedic Systems (IGOS) such as Orthopilots (CT-free navigation system) is considered to be one of the high-impact rendering driving factors for the segment growth.

Regional Takeaway

In terms of geography, the worldwide medical robotic system market is divided into North America, Latin America, Europe, Middle East & Africa, and the Asia Pacific. Among the above regions, the North America medical robotic system market accounted for the dominant value share in 2019. Organizations such as the Association of Manufacturing Technology (AMT), Association of Laboratory Automation (ALA), Automation Imaging Association (AF), and IEEE Robotics and Automation Society are actively involved in R&D activities to develop novel and advanced robotic systems for medical applications. This factor would, in turn, facilitate the regional growth to a higher level.

Europe’s medical robotic system market followed suit. Growth is primarily attributed to the rapid adoption of surgical robots in hospital facilities. The Asia Pacific is anticipated to expand at the rapid pace over the forecast period, owing to rising patient awareness, improving healthcare infrastructure, and the presence of emerging opportunities. Furthermore, advancements such as the introduction of new generation Robotic Surgical Technology (ROSA) in India that deals with an array of surgical interventions especially to treat Parkinson and Epilepsy is likely to propel the regional growth to great extent.

Key Vendor Takeaway

Few of the prominent market players responsible for the growth of the medical robotic systems market are iRobot Corporation, Titan Medical Inc., Medrobotics Corporation, Hansen, RenishawPlc, Health Robotics SLR, Intuitive Surgical, OR Productivity plc, Mazor Robotics, Accuray, Mako Surgical Corp., Varian Medical Systems, and Stereotaxis Inc.

The market players are focusing on collaborating with regional universities and hospitals for research and development purposes. In May 2019, Accuray Incorporated signed an agreement with Hong Kong Sanatorium & Hospital (HKSH) for the acquisition of correction technology and two Synchrony motion tracking. This collaboration was aimed to expand the use of motion and correction technologies with the hospital’s Radixact Systems.

The market size and forecast for each segment and sub-segments has been considered as below:

- Historical Year – 2015 to 2018

- Base Year – 2019

- Estimated Year – 2020

- Projected Year – 2026

TARGET AUDIENCE

- Traders, Distributors, and Suppliers

- Manufacturers

- Government and Regional Agencies

- Research Organizations

- Consultants

- Distributors

SCOPE OF THE REPORT

The scope of this report covers the market by its major segments, which include as follows:

MEDICAL ROBOTIC SYSTEMS MARKET KEY PLAYERS

- iRobot Corporation

- Medrobotics Corporation

- Titan Medical Inc.

- Hansen

- Renishaw plc

- Health Robotics SLR

- OR Productivity plc

- Intuitive Surgical

- Mazor Robotics

- Accuray

- Mako Surgical Corp.

- Varian Medical Systems

- Stereotaxis Inc.

- Others

MEDICAL ROBOTIC SYSTEMS MARKET BY TYPE

- Surgical Robots

- Neurosurgical Robotic Systems

- NeuroMate

- Pathfinder

- Renaissance

- Orthopedic Surgical Robots

- Robodoc

- Navio PFS

- iBlock

- MAKO RIO

- Stanmore Sculptor

- Laparoscopy Robotic Systems

- Telelap ALF-X surgical system

- Free-Hand endoscope holder system

- Da Vinci robotic surgery system

- Steerable Robotic Catheters

- Neurosurgical Robotic Systems

- Emergency response robotic systems

- Auto Pulse Plus robotic system

- LS-1 robotic system

- Noninvasive Radiosurgery Robots

- CyberKnife Robotic

- TrueBeam STx

- Gamma Knife Perfexion

- Rehabilitation Robots

- Therapeutic Robots

- Assistive Robots

- Prosthetics

- Orthotics

- Exoskeleton Robotic Systems

- Hospital and Pharmacy Robots

- Intravenous Robots

- Pharmacy Robots

- Telemedicine Robots

- Cart transportation robots

MEDICAL ROBOTIC SYSTEMS MARKET, BY APPLICATION

- Laparoscopy

- Neurology

- Orthopedics

- Special Education

- Others

MEDICAL ROBOTIC SYSTEMS MARKET, BY REGION

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Rest of Europe

- Asia Pacific

- India

- China

- South Korea

- Japan

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

TABLE OF CONTENT

1. MEDICAL ROBOTIC SYSTEMS MARKET OVERVIEW

1.1. Study Scope

1.2. Assumption and Methodology

2. EXECUTIVE SUMMARY

2.1. Market Snippet

2.1.1. Market Snippet by Type

2.1.2. Market Snippet by Application

2.1.3. Market Snippet by Region

2.2. Competitive Insights

3. MEDICAL ROBOTIC SYSTEMS KEY MARKET TRENDS

3.1. Market Drivers

3.1.1. Impact Analysis of Market Drivers

3.2. Market Restraints

3.2.1. Impact Analysis of Market Restraints

3.3. Market Opportunities

3.4. Market Future Trends

4. MEDICAL ROBOTIC SYSTEMS INDUSTRY STUDY

4.1. Porter’s Five Forces Analysis

4.2. Marketing Strategy Analysis

4.3. Growth Prospect Mapping

4.4. Regulatory Framework Analysis

4.5. COVID-19 Impact Analysis

4.5.1. Pre-COVID-19 Impact Analysis

4.5.2. Post-COVID-19 Impact Analysis

5. MEDICAL ROBOTIC SYSTEMS MARKET LANDSCAPE

5.1. Market Share Analysis

5.2. Key Innovators

5.3. Breakdown Data, by Key manufacturer

5.3.1. Established Player Analysis

5.3.2. Emerging Player Analysis

6. MEDICAL ROBOTIC SYSTEMS MARKET – BY TYPE

6.1. Overview

6.1.1. Segment Share Analysis, By Type, 2019 & 2026 (%)

6.2. Surgical Robots

6.2.1. Overview

6.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.3. Neurosurgical Robotic Systems

6.2.3.1. Overview

6.2.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.3.3. NeuroMate

6.2.3.3.1. Overview

6.2.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.3.4. Pathfinder

6.2.3.4.1. Overview

6.2.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.3.5. Renaissance

6.2.3.5.1. Overview

6.2.3.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.4. Orthopedic Surgical Robots

6.2.4.1. Overview

6.2.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.4.3. Robodoc

6.2.4.3.1. Overview

6.2.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.4.4. Navio PFS

6.2.4.4.1. Overview

6.2.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.4.5. iBlock

6.2.4.5.1. Overview

6.2.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.4.6. MAKO RIO

6.2.4.6.1. Overview

6.2.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.4.7. Stanmore Sculptor

6.2.4.7.1. Overview

6.2.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.5. Laparoscopy Robotic Systems

6.2.5.1. Overview

6.2.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.5.3. Telelap ALF-X surgical system

6.2.5.3.1. Overview

6.2.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.5.4. FreeHand endoscope holder system

6.2.5.4.1. Overview

6.2.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.5.5. Da Vinci robotic surgery system

6.2.5.5.1. Overview

6.2.5.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.2.6. Steerable Robotic Catheters

6.2.6.1. Overview

6.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3. Emergency response robotic systems

6.3.1. Overview

6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.3. Auto Pulse Plus robotic system

6.3.3.1. Overview

6.3.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.3.4. LS-1 robotic system

6.3.4.1. Overview

6.3.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4. Noninvasive Radiosurgery Robots

6.4.1. Overview

6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4.3. CyberKnife Robotic

6.4.3.1. Overview

6.4.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4.4. TrueBeam STx

6.4.4.1. Overview

6.4.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.4.5. Gamma Knife Perfexion

6.4.5.1. Overview

6.4.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5. Rehabilitation Robots

6.5.1. Overview

6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5.3. Therapeutic Robots

6.5.3.1. Overview

6.5.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5.4. Assistive Robots

6.5.4.1. Overview

6.5.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5.5. Prosthetics

6.5.5.1. Overview

6.5.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5.6. Orthotics

6.5.6.1. Overview

6.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.5.7. Exoskeleton Robotic Systems

6.5.7.1. Overview

6.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6. Hospital and Pharmacy Robots

6.6.1. Overview

6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6.3. Intravenous Robots

6.6.3.1. Overview

6.6.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6.4. Pharmacy Robots

6.6.4.1. Overview

6.6.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6.5. Telemedicine Robots

6.6.5.1. Overview

6.6.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

6.6.6. Cart transportation robots

6.6.6.1. Overview

6.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7. MEDICAL ROBOTIC SYSTEMS MARKET – BY APPLICATION

7.1. Overview

7.1.1. Segment Share Analysis, By Application, 2019 & 2026 (%)

7.2. Laparoscopy

7.2.1. Overview

7.2.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.3. Neurology

7.3.1. Overview

7.3.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.4. Orthopedics

7.4.1. Overview

7.4.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

7.5. Special Education

7.5.1. Overview

7.5.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8. MEDICAL ROBOTIC SYSTEMS MARKET– BY GEOGRAPHY

8.1. Introduction

8.1.1. Segment Share Analysis, By Region, 2019 & 2026 (%)

8.2. North America

8.2.1. Overview

8.2.2. Key Manufacturers in North America

8.2.3. North America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.2.4. North America Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.2.5. North America Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.2.6. U.S.

8.2.6.1. Overview

8.2.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.2.7. Canada

8.2.7.1. Overview

8.2.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3. Europe

8.3.1. Overview

8.3.2. Key Manufacturers in Europe

8.3.3. Europe Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.3.4. Europe Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.3.5. Europe Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.3.6. Germany

8.3.6.1. Overview

8.3.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.7. Italy

8.3.7.1. Overview

8.3.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.8. United Kingdom

8.3.8.1. Overview

8.3.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.9. France

8.3.9.1. Overview

8.3.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.3.10. Rest of Europe

8.3.10.1. Overview

8.3.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4. Asia Pacific (APAC)

8.4.1. Overview

8.4.2. Key Manufacturers in Asia Pacific

8.4.3. Asia Pacific Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.4.4. Asia Pacific Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.4.5. Asia Pacific Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.4.6. India

8.4.6.1. Overview

8.4.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.7. China

8.4.7.1. Overview

8.4.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.8. Japan

8.4.8.1. Overview

8.4.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.9. South Korea

8.4.9.1. Overview

8.4.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.4.10. Rest of APAC

8.4.10.1. Overview

8.4.10.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5. Latin America

8.5.1. Overview

8.5.2. Key Manufacturers in Latin America

8.5.3. Latin America Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.5.4. Latin America Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.5.5. Latin America Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.5.6. Brazil

8.5.6.1. Overview

8.5.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.7. Mexico

8.5.7.1. Overview

8.5.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.8. Argentina

8.5.8.1. Overview

8.5.8.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.5.9. Rest of LATAM

8.5.9.1. Overview

8.5.9.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6. Middle East and Africa

8.6.1. Overview

8.6.2. Key Manufacturers in Middle East and Africa

8.6.3. Middle East and Africa Market Size and Forecast, By Country, 2015 – 2026 (US$ Million)

8.6.4. Middle East and Africa Market Size and Forecast, By Type, 2015 – 2026 (US$ Million)

8.6.5. Middle East and Africa Market Size and Forecast, By Application, 2015 – 2026 (US$ Million)

8.6.6. Saudi Arabia

8.6.6.1. Overview

8.6.6.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

8.6.7. United Arab Emirates

8.6.7.1. Overview

8.6.7.2. Market Analysis, Forecast, and Y-O-Y Growth Rate, 2015 – 2026, (US$ Million)

9. KEY VENDOR ANALYSIS

9.1. Medrobotics Corporation

9.1.1. Company Snapshot

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Titan Medical Inc.

9.3. Hansen

9.4. Renishaw Plc

9.5. iRobot Corporation

9.6. Health Robotics SLR

9.7. OR Productivity plc

9.8. Intuitive Surgical

9.9. Mazor Robotics

9.10. Accuray

9.11. Mako Surgical Corp.

9.12. Varian Medical Systems

9.13. Stereotaxis Inc.

10. 360 DEGREE ANALYSTVIEW

11. APPENDIX

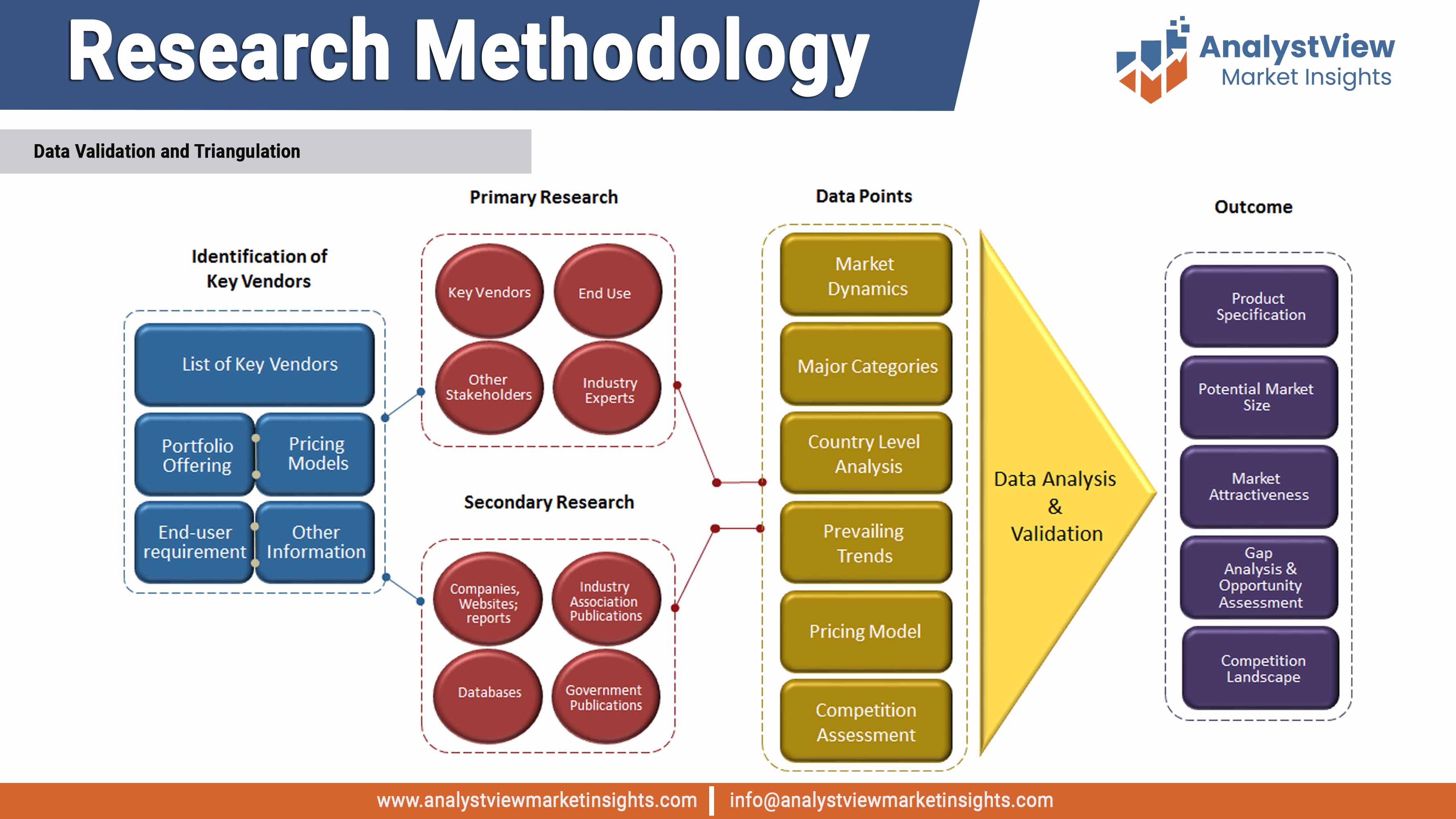

11.1. Research Methodology

11.2. References

11.3. Abbreviations

11.4. Disclaimer

11.5. Contact Us

List of Tables

TABLE List of data sources

TABLE Market drivers; Impact Analysis

TABLE Market restraints; Impact Analysis

TABLE Medical Robotic Systems market: Type Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Type

TABLE Global Medical Robotic Systems market, by Type 2015-2026 (USD Million)

TABLE Medical Robotic Systems market: Application Snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Application

TABLE Global Medical Robotic Systems market, by Application 2015-2026 (USD Million)

TABLE Medical Robotic Systems market: Regional snapshot (2018)

TABLE Segment Dashboard; Definition and Scope, by Region

TABLE Global Medical Robotic Systems market, by Region 2015-2026 (USD Million)

TABLE North America Medical Robotic Systems market, by Country, 2015-2026 (USD Million)

TABLE North America Medical Robotic Systems market, by Type, 2015-2026 (USD Million)

TABLE North America Medical Robotic Systems market, by Application, 2015-2026 (USD Million)

TABLE Europe Medical Robotic Systems market, by country, 2015-2026 (USD Million)

TABLE Europe Medical Robotic Systems market, by Type, 2015-2026 (USD Million)

TABLE Europe Medical Robotic Systems market, by Application, 2015-2026 (USD Million)

TABLE Asia Pacific Medical Robotic Systems market, by country, 2015-2026 (USD Million)

TABLE Asia Pacific Medical Robotic Systems market, by Type, 2015-2026 (USD Million)

TABLE Asia Pacific Medical Robotic Systems market, by Application, 2015-2026 (USD Million)

TABLE Latin America Medical Robotic Systems market, by country, 2015-2026 (USD Million)

TABLE Latin America Medical Robotic Systems market, by Type, 2015-2026 (USD Million)

TABLE Latin America Medical Robotic Systems market, by Application, 2015-2026 (USD Million)

TABLE Middle East and Africa Medical Robotic Systems market, by country, 2015-2026 (USD Million)

TABLE Middle East and Africa Medical Robotic Systems market, by Type, 2015-2026 (USD Million)

TABLE Middle East and Africa Medical Robotic Systems market, by Application, 2015-2026 (USD Million)

List of Figures

FIGURE Medical Robotic Systems market segmentation

FIGURE Market research methodology

FIGURE Value chain analysis

FIGURE Porter’s Five Forces Analysis

FIGURE Market Attractiveness Analysis

FIGURE COVID-19 Impact Analysis

FIGURE Pre & Post COVID-19 Impact Comparision Study

FIGURE Competitive Landscape; Key company market share analysis, 2018

FIGURE Type segment market share analysis, 2019 & 2026

FIGURE Type segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Surgical Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Neurosurgical Robotic Systems market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE NeuroMate market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Pathfinder market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Renaissance market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Orthopedic Surgical Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Robodoc market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Navio PFS market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE iBlock market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE MAKO RIO market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Stanmore Sculptor market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Laparoscopy Robotic Systems market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Telelap ALF-X surgical system market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE FreeHand endoscope holder system market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Da Vinci robotic surgery system market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Steerable Robotic Catheters market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Emergency response robotic systems market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Auto Pulse Plus robotic system market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE LS-1 robotic system market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Noninvasive Radiosurgery Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE CyberKnife Robotic market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE TrueBeam STx market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Gamma Knife Perfexion market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rehabilitation Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Therapeutic Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Assistive Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Prosthetics market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Orthotics market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Exoskeleton Robotic Systems market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Hospital and Pharmacy Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Intravenous Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Pharmacy Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Telemedicine Robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Cart transportation robots market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Application segment market share analysis, 2019 & 2026

FIGURE Application segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Neurology market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Orthopedics market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Laparoscopy market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Special Education market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Regional segment market share analysis, 2019 & 2026

FIGURE Regional segment market size forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE North America Medical Robotic Systems market share and leading players, 2018

FIGURE Europe Medical Robotic Systems market share and leading players, 2018

FIGURE Asia Pacific Medical Robotic Systems market share and leading players, 2018

FIGURE Latin America Medical Robotic Systems market share and leading players, 2018

FIGURE Middle East and Africa Medical Robotic Systems market share and leading players, 2018

FIGURE North America Medical Robotic Systems market share analysis by country, 2018

FIGURE U.S. Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Canada Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Europe Medical Robotic Systems market share analysis by country, 2018

FIGURE Germany Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Spain Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Italy Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE UK Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE France Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of the Europe Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Asia Pacific Medical Robotic Systems market share analysis by country, 2018

FIGURE India Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE China Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Japan Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE South Korea Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Singapore Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of APACMedical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin America Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Latin AmericaMedical Robotic Systems market share analysis by country, 2018

FIGURE Brazil Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Mexico Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Argentina Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Rest of LATAM Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE Middle East and Africa Medical Robotic Systems market share analysis by country, 2018

FIGURE Saudi Arabia Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

FIGURE United Arab Emirates Medical Robotic Systems market size, forecast and trend analysis, 2015 to 2026 (USD Million)

Related Reports

Credibility and Certifications

Trusted Insights, Certified Excellence! Coherent Market Insights is a certified data advisory and business consulting firm recognized by global institutes.

ISO 9001:2015

ISO 9001:2015

ESOMAR Corporate

ESOMAR Corporate

GDPR Compliance

GDPR Compliance

D-U-N-S Registered

D-U-N-S Registered

BBB Accreditation

BBB Accreditation

MRS

MRS